Vermont Real Estate Withholding Tax . real estate withholding tax. (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. state income tax is due on capital gains realized from the sale of vermont real property, whether the seller is a. In vermont, sellers of real property who are not residents of the state are subject to a real estate. real estate withholding tax this tax requires taxpayers withhold 2.5% of the consideration for real property being sold by. (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a.

from nydiaqstephannie.pages.dev

state income tax is due on capital gains realized from the sale of vermont real property, whether the seller is a. In vermont, sellers of real property who are not residents of the state are subject to a real estate. real estate withholding tax. (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. real estate withholding tax this tax requires taxpayers withhold 2.5% of the consideration for real property being sold by. (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a.

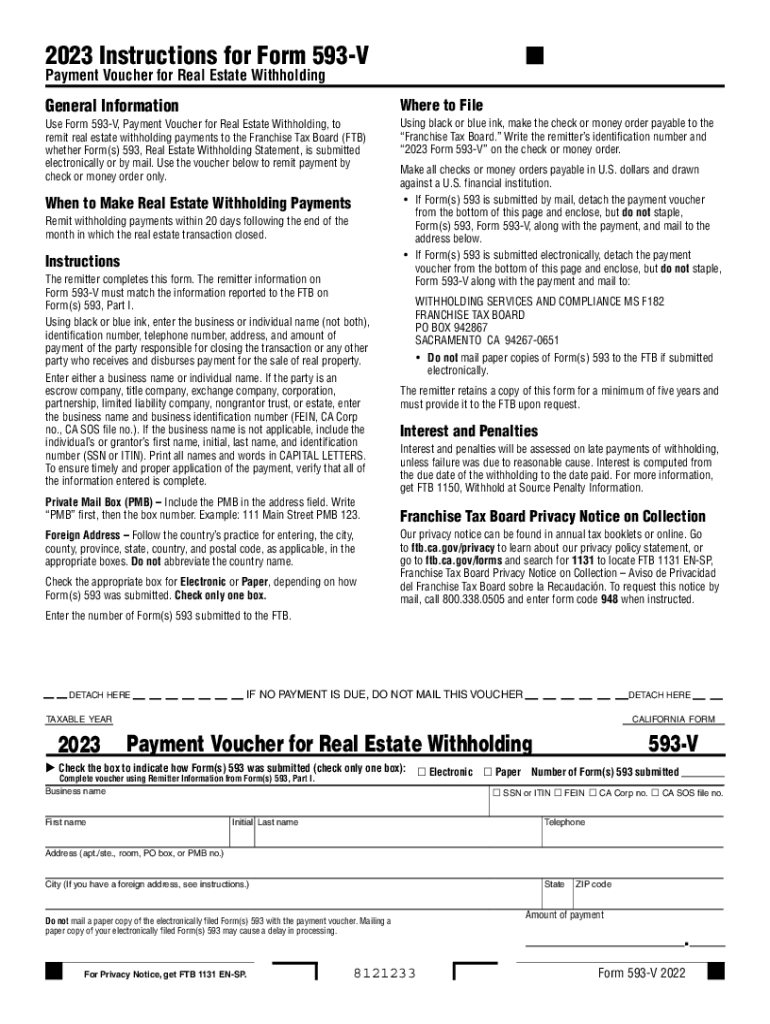

Form 593 California 2024 Lenna Tatiania

Vermont Real Estate Withholding Tax real estate withholding tax this tax requires taxpayers withhold 2.5% of the consideration for real property being sold by. (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. real estate withholding tax this tax requires taxpayers withhold 2.5% of the consideration for real property being sold by. (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. real estate withholding tax. In vermont, sellers of real property who are not residents of the state are subject to a real estate. state income tax is due on capital gains realized from the sale of vermont real property, whether the seller is a.

From www.xoatax.com

Vermont Property Tax Rates Highlights 2024 Vermont Real Estate Withholding Tax (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. state income tax is due on capital gains realized from the sale of vermont real property, whether the seller is a. real estate withholding tax. real estate withholding tax this tax requires. Vermont Real Estate Withholding Tax.

From www.numerade.com

Continuing Payroll Project Prevosti Farms and Sugarhouse (Static) The Vermont Real Estate Withholding Tax real estate withholding tax this tax requires taxpayers withhold 2.5% of the consideration for real property being sold by. (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. state income tax is due on capital gains realized from the sale of vermont. Vermont Real Estate Withholding Tax.

From listwithclever.com

Vermont Real Estate Market May 2022 Forecasts + Trends Vermont Real Estate Withholding Tax (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. real estate withholding tax this tax requires taxpayers withhold. Vermont Real Estate Withholding Tax.

From www.formsbank.com

Form Rew1 Vermont Withholding Tax Return For Transfer Of Real Vermont Real Estate Withholding Tax In vermont, sellers of real property who are not residents of the state are subject to a real estate. real estate withholding tax this tax requires taxpayers withhold 2.5% of the consideration for real property being sold by. state income tax is due on capital gains realized from the sale of vermont real property, whether the seller is. Vermont Real Estate Withholding Tax.

From www.formsbank.com

Form E1 Vermont Estate Tax Return printable pdf download Vermont Real Estate Withholding Tax real estate withholding tax this tax requires taxpayers withhold 2.5% of the consideration for real property being sold by. real estate withholding tax. state income tax is due on capital gains realized from the sale of vermont real property, whether the seller is a. (a) except as otherwise provided in this section, in the case of. Vermont Real Estate Withholding Tax.

From www.formsbank.com

Fillable Form Rw171 Vermont Withholding Tax Return For Transfer Of Vermont Real Estate Withholding Tax In vermont, sellers of real property who are not residents of the state are subject to a real estate. state income tax is due on capital gains realized from the sale of vermont real property, whether the seller is a. (a) except as otherwise provided in this section, in the case of any sale or exchange of real. Vermont Real Estate Withholding Tax.

From nydiaqstephannie.pages.dev

Form 593 California 2024 Lenna Tatiania Vermont Real Estate Withholding Tax real estate withholding tax this tax requires taxpayers withhold 2.5% of the consideration for real property being sold by. real estate withholding tax. (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. In vermont, sellers of real property who are not residents. Vermont Real Estate Withholding Tax.

From www.withholdingform.com

Colorado Real Estate Transfer Withholding Tax Form Vermont Real Estate Withholding Tax real estate withholding tax this tax requires taxpayers withhold 2.5% of the consideration for real property being sold by. (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. state income tax is due on capital gains realized from the sale of vermont. Vermont Real Estate Withholding Tax.

From www.templateroller.com

Download Instructions for VT Form LGT177 Vermont Land Gains Vermont Real Estate Withholding Tax state income tax is due on capital gains realized from the sale of vermont real property, whether the seller is a. In vermont, sellers of real property who are not residents of the state are subject to a real estate. real estate withholding tax. (a) except as otherwise provided in this section, in the case of any. Vermont Real Estate Withholding Tax.

From www.xoatax.com

Vermont Property Tax Rates Highlights 2024 Vermont Real Estate Withholding Tax real estate withholding tax. state income tax is due on capital gains realized from the sale of vermont real property, whether the seller is a. real estate withholding tax this tax requires taxpayers withhold 2.5% of the consideration for real property being sold by. In vermont, sellers of real property who are not residents of the state. Vermont Real Estate Withholding Tax.

From www.formsbank.com

Fillable Rew Schedule A (Rw171) Vermont Withholding Tax Return For Vermont Real Estate Withholding Tax In vermont, sellers of real property who are not residents of the state are subject to a real estate. (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. real estate withholding tax. real estate withholding tax this tax requires taxpayers withhold 2.5%. Vermont Real Estate Withholding Tax.

From www.templateroller.com

VT Form LGT177 Fill Out, Sign Online and Download Fillable PDF Vermont Real Estate Withholding Tax real estate withholding tax. (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. real estate withholding tax this tax requires taxpayers withhold 2.5% of the consideration for real property being sold by. state income tax is due on capital gains realized. Vermont Real Estate Withholding Tax.

From www.dochub.com

How to Fill Out Real Estate Withholding CertificateFreedom Tax Vermont Real Estate Withholding Tax (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. In vermont, sellers of real property who are not residents of the state are subject to a real estate. state income tax is due on capital gains realized from the sale of vermont real. Vermont Real Estate Withholding Tax.

From www.withholdingform.com

Form 593 Real Estate Withholding Tax Statement 2022 Vermont Real Estate Withholding Tax (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. real estate withholding tax this tax requires taxpayers withhold 2.5% of the consideration for real property being sold by. In vermont, sellers of real property who are not residents of the state are subject. Vermont Real Estate Withholding Tax.

From www.templateroller.com

VT Form WHT430 Download Fillable PDF or Fill Online Withholding Tax Vermont Real Estate Withholding Tax (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. state income tax is due on capital gains realized from the sale of vermont real property, whether the seller is a. In vermont, sellers of real property who are not residents of the state. Vermont Real Estate Withholding Tax.

From www.signnow.com

Bi 471 Vermont Complete with ease airSlate SignNow Vermont Real Estate Withholding Tax In vermont, sellers of real property who are not residents of the state are subject to a real estate. (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. state income tax is due on capital gains realized from the sale of vermont real. Vermont Real Estate Withholding Tax.

From www.formsbank.com

Fillable State Of Vermont Department Of Taxes Vermont Employee'S Vermont Real Estate Withholding Tax (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. real estate withholding tax. (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. real estate withholding tax. Vermont Real Estate Withholding Tax.

From www.formsbank.com

Fillable Form Rw171 Vermont Withholding Tax Return For Transfer Of Vermont Real Estate Withholding Tax real estate withholding tax. In vermont, sellers of real property who are not residents of the state are subject to a real estate. real estate withholding tax this tax requires taxpayers withhold 2.5% of the consideration for real property being sold by. state income tax is due on capital gains realized from the sale of vermont real. Vermont Real Estate Withholding Tax.